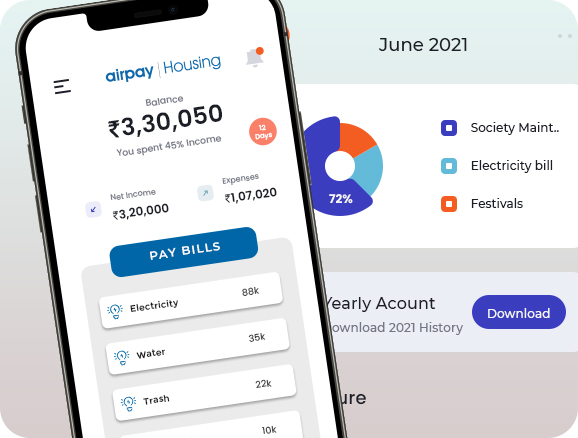

Give Your Society A Digital Payments Makeover

Tired of going around residences asking for payments from residents? Facing difficulty in account reconciliation and managing defaulters?

With Airpay’s societypay solution, smoothen your daily operations. We promise to deliver a hassle-free modern payment solution for you and your residents

YOUR CHALLENGES

Difficulty in Managing Cash

- Security issues during handling cash

- Timely payment disbursement to multiple vendor

SOLUTIONS

Spoil residents with choices

- Options to choose from debit cards to credit cards, internet banking to UPI from 45+ partner banks

- Allow residents to pay from the comfort of their homes or make physical payments at your front office

Features of airpay Society Payment Solutions

Automated Task Management

Automated invoicing, settlement, payment reminder & reconciliation

Residents Management System

Manage past and current records of all residents on our platform for easy one-stop access

Digitalize IT

Maintain digital records & get access to Settlement reports, MIS reports, late payments/ defaulters list, activity reports etc

Realize ROI Quickly

With quick integration and easy onboarding, digitally empower your society

High level of Customization

Using your white-labeled dashboard, create events; send out notifications for new/overdue payments

Advanced Data Analytics

Enhance your operational efficiency with data backed business insights

Exclusive Pricing for Society Sector

Zero Setup Fee

Zero AMC

Zero Hidden Fee

Credit Cards

-

Master CardVISAAmerican Express1.90%

-

International3.10%

-

Corporate / Premium2.75%

Debit Cards

-

Transaction Amount < ₹20000.45%

-

Transaction Amount > ₹20000.95%

-

EMI Banks (Axis, Kotak, SBI, HDFC,

Yes Bank, SCB, RBL, ICICI, HSBC)1.90% -

Wallets1.85%

-

Buy Now Pay Later1.90%

-

Bharat QR1.00%

-

FX Payments4.00%

-

Net BankingLarge Banks - 1.75%Small Banks - 1.45%

-

Subscriptions

(eNACH & UPI Autopay)₹15 per mandateregistration and₹12 per presentation -

Cash Management0.50%

Credit Cards

-

Master CardVISAAmerican Express1.90% for non-GST merchants2.0% for GST merchants

-

International3.10%

-

Corporate / Premium2.75%

Debit Cards

-

Transaction Amount < ₹20000.45%

-

Transaction Amount > ₹20000.95%

-

EMI Banks (Axis, Kotak, SBI, HDFC,

Yes Bank, SCB, RBL, ICICI, HSBC)1.90% -

Wallets1.85%

-

Buy Now Pay Later1.90%

-

Bharat QR1.00%

Please Note:

T & C apply

- One Time or Recurring rental fees for services as applicable

- For POS- Both MDR and surcharge pricing models are available

- airpay reserves the right to modify its pricing structure at any time, without prior notice